SHAH ALAM: Boustead Heavy Industries Corporation Bhd (BHIC), the heavy industry arm of Boustead Holdings Bhd, is selling its entire stake in Boustead Naval Shipyard Sdn Bhd (BNS) – the builder of the LCS – for RM1 – to Ocean Sunshine Bhd (OSB). OSB is an indirect unit of Minister of Finance (Inc).

Although the release said the sale only cost RM1, the actual amount is much higher as OSB will be taking over the liabilities of BNS and it will also be paying BHIC and its subsidiaries some RM400 million of debt. (see below for the full explaination.)

The disposal of the 27 million shares or 20.77 percent held by BHIC’s indirect wholly owned subsidiary Perstim Industries Sdn Bhd, is to facilitate the government’s decision to acquire 100 per cent of BNS shares to ensure the completion of the LCS, BHIC said in a filing with Bursa Malaysia on August 21. Loss making BNS is in involved in the construction, repair, and maintenance of naval ships, mostly for the RMN.

The other shareholders of BNS according to the filing is Boustead Holdings, LTAT and the MOF. It is also likely that Boustead Holdings and LTAT will also dispose their stake in BNS to the OSB.

The disposal of BNS to OSB also means that the company (which is we, the taxpayers) will take over BNS’s liabilities of RM848.45 million recorded under the 2022 financial-year. BNS also recorded after profit loss of RM150 million for the same time-period.

As part of the disposal agreement, BNS will need to pay BHIC some RM400 million owed by the latter to the former and its relevant subsidiaries, following to due diligence and agreement by all parties.

Does this mean the cost of building the five LCS is now RM12.44 billion (RM848.5 million liabilities plus the RM400 million needed to be paid to BHIC and its subsidiaries) instead of the RM11.2 billion, announced last May? Or the increase from RM9.1 billion to RM11.2 billion is the sum above? I believe RM12.44 billion is now the current cost of the project as previous releases by BHIC and Boustead did not mention the liabilities and the money needed to be paid to BHIC by selling BNS to the government. As I said previously, I was told that the project will cost between RM12 billion to RM14 billion though this was for six ships.

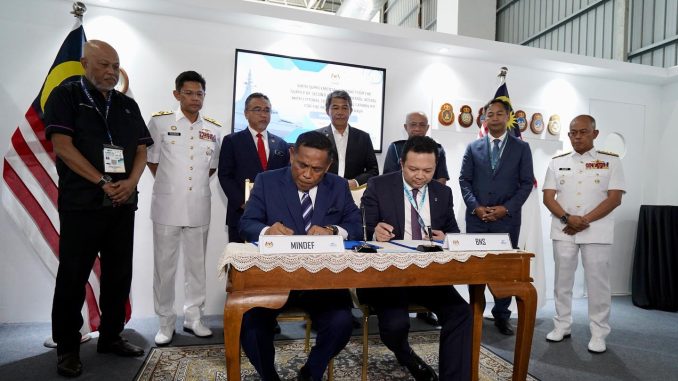

BNS announced the additional cost for the LCS after Defence Minister DSU Mohamad Hasan witnessed the signing of the sixth supplementary LCS contract and the decision to nationalise BNS by putting it under MOF-owned company at LIMA 2023.

It is interesting to note that OSB was incorporated in Malaysia on 17 June 2022 under the Companies Act, 2016 as a public limited company. As at the date of this announcement, the issued share capital of OSB is RM1.00 comprising of 1 ordinary share.

OSB is wholly owned by AES Solutions Sdn Bhd, which is indirectly wholly owned by MOF and Pesuruhjaya Tanah Persekutuan. AES Solutions is the operator of Automated Enforcement System (AES) which took over from two private companies. The company was incorporated on September 2, 2013 and has two directors. The two directors are part of the senior management of Prokhas, a company wholly owned by the Ministry of Finance. A check on Prokhas website showed that the company is managed by economists and accountants.

BHIC said in the filing:

The Proposed Disposal serves to facilitate the decision of the Government of Malaysia, through

the Ministry of Finance’s letter to the Company dated 25 May 2023, to acquire 100% of shares in

BNS in order to ensure the completion of the Littoral Combat Ship (“LCS”) project. It is also

formed as part of the Company’s operational and organizational restructuring to streamline and

re-align entities within the Company and its relevant subsidiaries, while ensuring that BNS is able

to complete the construction and delivery of the LCS to the RMN within the stipulated timeframe

pursuant to the LCS contract.

Further to the above, the introduction of a new strategic shareholder into BNS namely OSB, is in

consonance with BNS’ plans to strengthen its business and operations in relation to the

construction, repair and maintenance of naval ships and commercial ship building.

The proposed disposal is expected to be completed by the fourth quarter of 2023.

Updated with the comments on the cost of the LCS.

— Malaysian Defence

Rm 850mil of taxpayer monies just to save BNS and we only got back what’s worth RM 450mil so BHIC still got a healthy profit of RM 400mil for their failed management. Isnt it the same as Proton (preGeely) or MAS? So where is the change that people voted for?

Zilch! You’d be an idiot if you think otherwise

Its a sad chapter for a once strong conglomerate with a sizeable stakeholders are members of the armed forces, due to the short sightedness and the greediness of politician

There were 9.8mil voters last GE15. Can’t be that 5+ mil voters are idiots? :hmm:

“the project will cost between RM12 billion to RM14 billion though this was for six ships.”

Yup, this was exactly that I predicted the ballpark figures when this whole issue started blowing up. It was unrealistic to expect a high tech frigate class warship to come under RM 2bil back then whatmore in today’s scenario with high inflation and weakening of RM. And I can tell you now the final figures will be closer to 14 than 12 bil ringgit, once we buy MICA NG & torps.

So in the end did we learn anything? Going by the LMS2 budget of RM 833mil per boat for these specs; “Requirements are a length of 85-100m, an endurance of 4,000nm/21 days, a top speed of 28kt and a cruising speed of 14kt. Armaments will comprise a 57mm naval gun, two Naval Strike Missile launchers, twin 30mm cannons and the future ability to carry air defence missiles”.

Yeah I don’t think we have learned our lesson here about making a purse out of a sow’s ears unless they grossly reduce the specs & many FFBNW. Want my prediction? This also will be grossly over the budget, but whether the Govt of the day will be honest about the actual figures is another story.

@ joe

Q: Can they get a corvette from the USD180 mil per ship budget?

A: Of course can. Philippines Navy got the Jose Rizal class Frigate for less.

.

.

.

Q: Should we really get corvettes for that USD 540 million (for batch 1 of 3 ships) and USD 900 million (for batch 2 of 5 ships) budget?

A: I am of the opinion of we should not. We should build a navy prepared for future challenges, not for past challenges.

@Kamal A

Define strong? While Boustead were into a lot of ventures & businesses they weren’t particularly strong or leading in any of them. BHIC were afloat due to Govt orders, Pharmaniaga main business was just repackaging generic medicines for Govt hospitals & clinics, and was undone due to massed buy of Sinovac which didn’t get used by Govt. AFAIK there weren’t anything which they had excelled. And this is typical of GLCs, if they aren’t losing money they weren’t making lots of profits either.

@hulubalang

“Of course they can”

But not without a lot of caveats. There is no TOT & local build there which our beancounters & politicians won’t wear it. There are no choice other than the OEM selected systems & weaponry, the endusers won’t wear it as they have no freedom of choice and might be incompatible with their existing eco system or increase the logistcs & maintenance burden. The you-know-who won’t wear it as it has Israeli systems onboard. We don’t know if there had been any subsidies from Korean Govt in order to seal the deal, this could be a one off and not likely to repeat so the true figures might be much higher than reported.

And mind you the JR project is not without its own controversies and scandals. The last thing we need to finding out some politicians have fistful of Won in their pockets.

Joe “And this is typical of GLCs, if they aren’t losing money they weren’t making lots of profits either.”

Depends, some GLCs like khazanah, Petronas, PNB etc etc which are professionally run by lawyer & accountant are extremely profitable that’s they hordes 60% of BSKL values. Some GLCs however becomes golden parachute sites for retired civil servants & politicians do not.

Joe “Want my prediction? This also will be grossly over the budget”

Technically like the LCS, there’s a off the shelf ship that fit the requirements like a gloves. Whether the platform of choice get choosen particularly as politicians medle around is another story.

If the wrong platform is choosen then sure plenty of money gonna be burnt for Intergration cost to fit RMN requirements

Khazanah & PNB had the advantage to put money into utilities & essential services, which are sure profit entities, plus they are allowed to invest overseas with less scrutiny from BNM. Petronas is O&G, so another sure profit business. Yes those running these GLCs are technocrats and professionals, salute to what they achieved. But with such surety it isn’t a hard hurdle to manage. Unlike private venture capitalist, they didn’t unlock many unicorns ie Alibaba, Farm Fresh are just a few only.

Majority our GLCs, either ran by professionals or politicians, are just middling as mostly are limited to local investments and the ringgit can only go around for so far. Many, like TH & Boustead & KWSP, are being forced to let go their investments and assets during the past few years. The way I see it, things are not well and nobody is revealing the truth.

“there’s a off the shelf ship that fit the requirements like a gloves”

Do tell which ship design is that. I doubt there are any equipment which fits like a T unless its specifically designed for us, I really highly doubt that but Im willing to be surprised. Platforms are meant to be flexible, but it is how much that flexibility aligns to what we operate and what new additions we want to have will determine how big the gap for integration we will need to do.

Our biggest issue is that we want to make it our own, without the money and experience to do it. And that is the start of the problem. The Gowind 2500 is good enough for our needs even though it was a paper ship in 2009/2011. If you look at the Damen 10513/14, which was the design preferred by the RMN, is the same as the Gowind 2500. The main differences were the mission systems, really. I am not saying that the RMN was wrong in choosing the Damen design though. It was not a paper design in 2009 so it was the best way forward for the RMN.

Boustead,

Rather than leave MHS EC225LP idle and not used, please donate/pass them on to RMAF.

Looks like Boustead is even selling their palm oil plantations for about RM747 million.

So what is next for Boustead? What business will it be doing in the future?

It should be donated to APMM instead. It’s cheaper to make them available for APMM

It will return to be like KWSP like it used to be instead of being the piggy bank for the government of the day. Selling the plantation subsidiary is one of the regularisation exercise which will lead to Boustead being privately hold by LTAT. There were also offers for Pharmaniaga but Tok Mat said no, over my dead body.

Gowind is a great ship but unfortunately it’s system & effectors aren’t suitable for RMN needs & the Intergration cost to change the system & effector would burst the bank which is probably why RMN back then preferred the damen design.

The same thing would likely happened again if the current politicians get their way like back then on their ada class obsession.

“Our biggest issue is that we want to make it our own”

Exactly! We like to spend taxpayers monies for projects which could work if we had put enough money & resources. Yet because we are short in both these become angan taik ayam projects which ultimately fail. Talking about the LCS, I doubt going for Sigma would have been any better. Why? Because we’d still will have to upsize the vessel and redesign it to be a 3000+ ton frigate, something Damen doesn’t have in their catalogue. So either Sigma or Gowind, would not have changed the ultimate outcome as the key points of failure – local redesign, technical challenges, insufficient budget – would still be there.

“There were also offers for Pharmaniaga but Tok Mat said no”

Pharmaniaga is a key strategic asset as the main supplier of medicine to the Govt. Plus they might want to keep the reason for Sinovac scandal loses under wraps, something which have to be revealed if transfer to private ownership.

Actually the palm oil plantation deal is for 3.47 billion ringgit, the 747 million figure was in USD.

3.47 billion ringgit is a lot of cash. What kind of alternative investment for those billions of ringgit that would give much better returns than palm oil plantation?

Aerospace manufacturing?

Semiconductors?

Buying foreign high tech businesses?

IMO another military business will not give as much return in investment as palm oil plantations.

Re: MHS EC225LP

I don’t think APMM has a requirement for EC225LP. TUDM on the other hand, has a want of more medium lift helicopters. Leased AW139 does not actually fulfill the needs of TUDM. Boustead, in this few days has billions in cash from asset selling, while getting rid of billions of liability with the government buying BNS. Passing those EC225LP to TUDM, will give valuable assets that is badly needed by TUDM, while having negligible impact to Boustead financials.

Firstly palm oil is recurring business so selling your cash cow isnt such a great idea. OTOH palm oil itself have been under pressure from EU lobby & boycott, China’s reduced buys, India also reduced their food oil imports, so palm oil isnt so hot as before but still not a sunset business that would be sold as of today.

If they willing to do that, they needed the money for something else and they aren’t in a mood to donate a few millions RM worth of aircraft. This is like CSR to the extreme unless BNS is worth multi billions and rake in billions per year, so yeah not happening.

The government has relieved Boustead of billions of liability by taking over BNS, releasing a few million of asset in the shape of 5 EC225LP that has not making any returns for more than 5 years now should be miniscule in comparison.

They are going to make any money by hoarding those EC225LP.

They will also get 3.47 billion ringgit in cash for the sale of their plantations this year. In context of this, the EC225LP value is nothing for Boustead (probably 1% of the profit generated by the plantation sale), while those same helicopter to be able to fly with TUDM means a lot to the overall mission capability of defending our country.